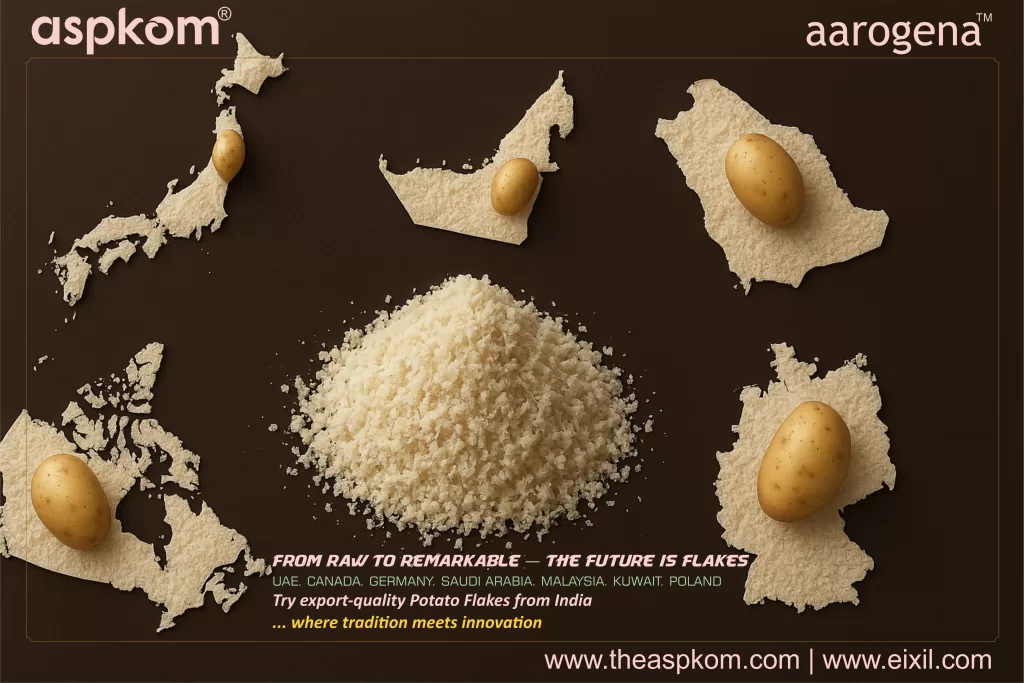

AspKom®: Your Gateway to Authentic Aarogena Indian Potato Flakes, Spices, and Nutraceuticals – Trust, Quality, and Global Partnerships

Discover why global importers from the UAE, Saudi Arabia, Germany, and beyond are turning to AspKom® for premium Indian potato flakes, herbs, and nutraceuticals. Ensure authenticity, quality, and innovation. Connect today!